Enrich Transactions

Transaction Data API

Transaction Data API

With our transaction data enrichment API, categorize card and account transactions in the most granular and accurate way and enrich transactions with all the information your users expect in their bank or fintech app.

With our transaction data enrichment API, categorize card and account transactions in the most granular and accurate way and enrich transactions with all the information your users expect in their bank or fintech app.

Smart Product Matching

Enrich Transactions

Enrich Transactions

Transaction Data API

Transaction Data API

With our transaction data enrichment API, categorize card and account transactions in the most granular and accurate way and enrich transactions with all the information your users expect in their bank or fintech app.

With our transaction data enrichment API, categorize card and account transactions in the most granular and accurate way and enrich transactions with all the information your users expect in their bank or fintech app.

The First Truly Global

Transaction Categorizer

01

Turnkey: plug and play API from day 1 No training needed

02

Country-agnostic: we enrich transactions from virtually all countries

03

A single API endpoint, returning 5 enrichment fields

Insights

Why Genify?

Your partner to unlock value in transaction data

Ease of Integration

Via a vast, well-documented set of API endpoints

On Premises or Cloud

Our API runs on your premises or in the cloud, thanks to a hybrid build since

Day 1

ISO 27001

Our servers are ISO 27001 certified, and our data usage is compliant with GDPR

Continuous Upgrades

Your subscription gives access to new features, sourced directly from our existing users

Home

Card

Profile

Transaction

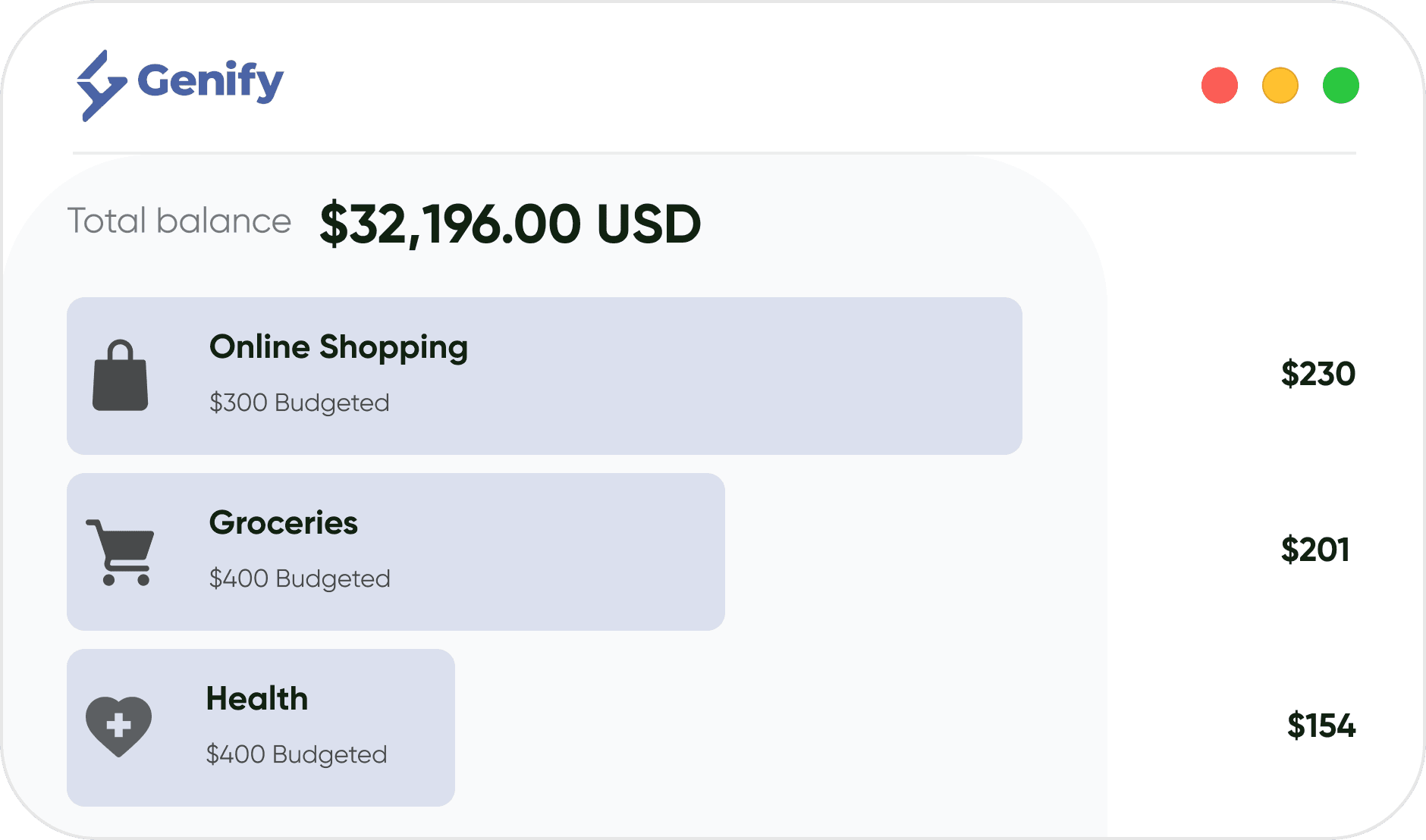

Total balance

$42,295.00 USD

Toni Kross

Good Morning

$300 Budgeted

Shopping Online

$230

$400 Budgeted

Groceries

$201

$400 Budgeted

Food & Drink

$201

$120 Budgeted

Beauty

$40

$120 Budgeted

Health

$10

Insights

Why Genify?

Your partner to unlock value in transaction data

Ease of Integration

Via a vast, well-documented set of API endpoints

On Premises or Cloud

Our API runs on your premises or in the cloud, thanks to a hybrid build since Day 1

ISO 27001

Our servers are ISO 27001 certified, and our data usage is compliant with GDPR

Continuous Upgrades

Your subscription gives access to new features, sourced directly from our existing users

Insights

Why Genify?

Your partner to unlock value in transaction data

Ease of Integration

Via a vast, well-documented set of API endpoints

On Premises or Cloud

Our API runs on your premises or in the cloud, thanks to a hybrid build since

Day 1

ISO 27001

Our servers are ISO 27001 certified, and our data usage is compliant with GDPR

Continuous Upgrades

Your subscription gives access to new features, sourced directly from our existing users

Home

Card

Profile

Transaction

Total balance

$42,295.00 USD

Toni Kross

Good Morning

$300 Budgeted

Shopping Online

$230

$400 Budgeted

Groceries

$201

$400 Budgeted

Food & Drink

$201

$120 Budgeted

Beauty

$40

$120 Budgeted

Health

$10

Insights

Why Genify?

Your partner to unlock value in transaction data

Ease of Integration

Via a vast, well-documented set of API endpoints

On Premises or Cloud

Our API runs on your premises or in the cloud, thanks to a hybrid build since Day 1

ISO 27001

Our servers are ISO 27001 certified, and our data usage is compliant with GDPR

Continuous Upgrades

Your subscription gives access to new features, sourced directly from our existing users

The First Truly Global

Transaction Categorizer

The First Truly Global

Transaction Categorizer

01

Turnkey: plug and play API from day 1 No training needed

02

Country-agnostic: we enrich transactions from virtually all countries

03

A single API endpoint, returning 5 enrichment fields

Unlock value with 5 enrichment fields

Genify’s engine is designed to automatically categorize card (credit and debit) and account transactions into granular expense and income categories, leveraging machine learning to enhance the quality of bank transaction data. Our engine also provides a merchant’s clean name, logo, website, and calculates as bonus the carbon footprint of the transaction.

Genify’s engine is designed to automatically categorize card (credit and debit) and account transactions into granular expense and income categories, leveraging machine learning to enhance the quality of bank transaction data. Our engine also provides a merchant’s clean name, logo, website, and calculates as bonus the carbon footprint of the transaction.

Enrichment Fields

Enrichment Fields

Unlock value with 5 enrichment fields

Unlock value with 5 enrichment fields

Genify’s engine is designed to automatically categorize card (credit and debit) and account transactions into granular expense and income categories, leveraging machine learning to enhance the quality of bank transaction data. Our engine also provides a merchant’s clean name, logo, website, and calculates as bonus the carbon footprint of the transaction.

Genify’s engine is designed to automatically categorize card (credit and debit) and account transactions into granular expense and income categories, leveraging machine learning to enhance the quality of bank transaction data. Our engine also provides a merchant’s clean name, logo, website, and calculates as bonus the carbon footprint of the transaction.

Category

Categorize transactions into more than 70 expense and income categories.

Category

Categorize transactions into more than 70 expense and income categories.

Category

Categorize transactions into more than 70 expense and income categories.

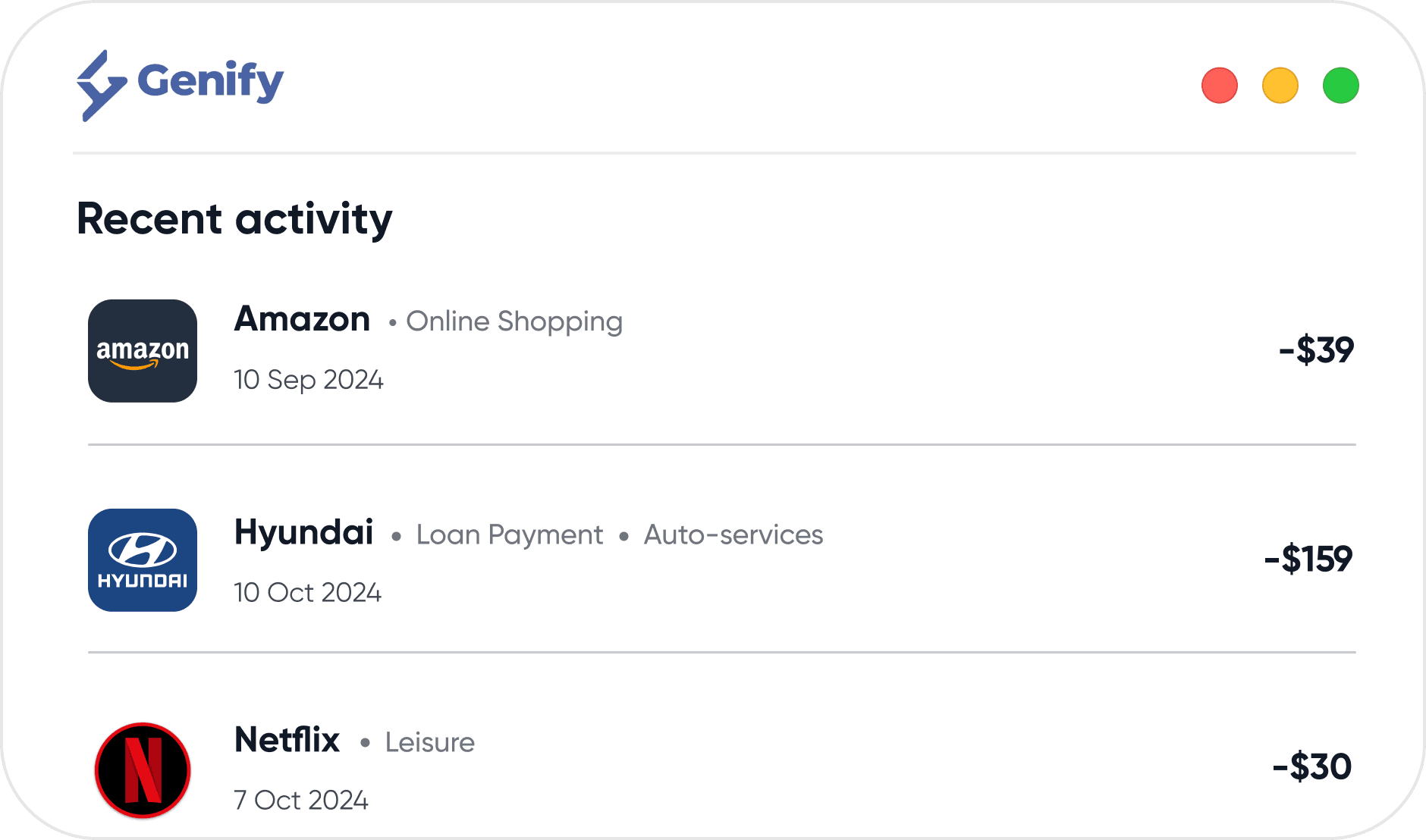

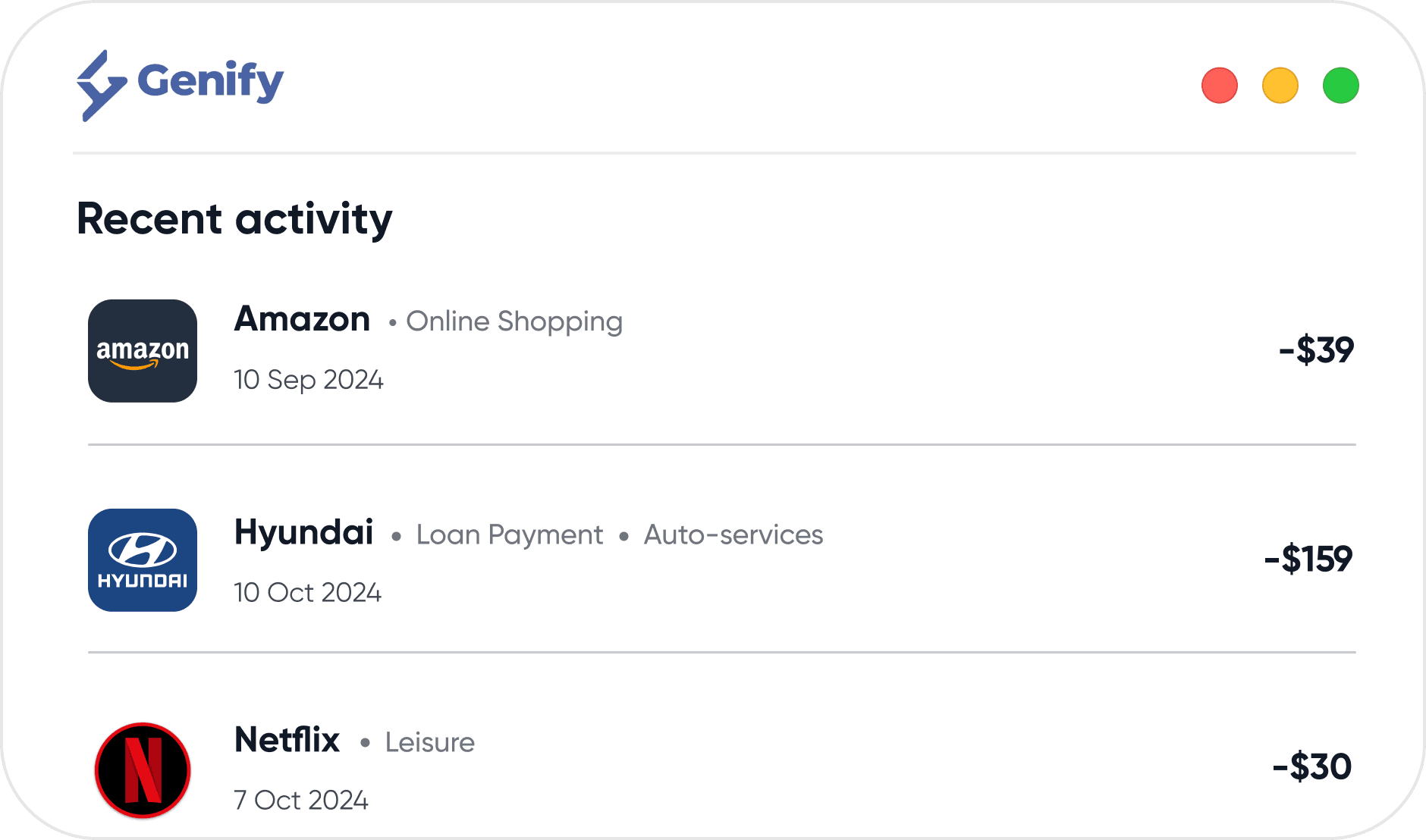

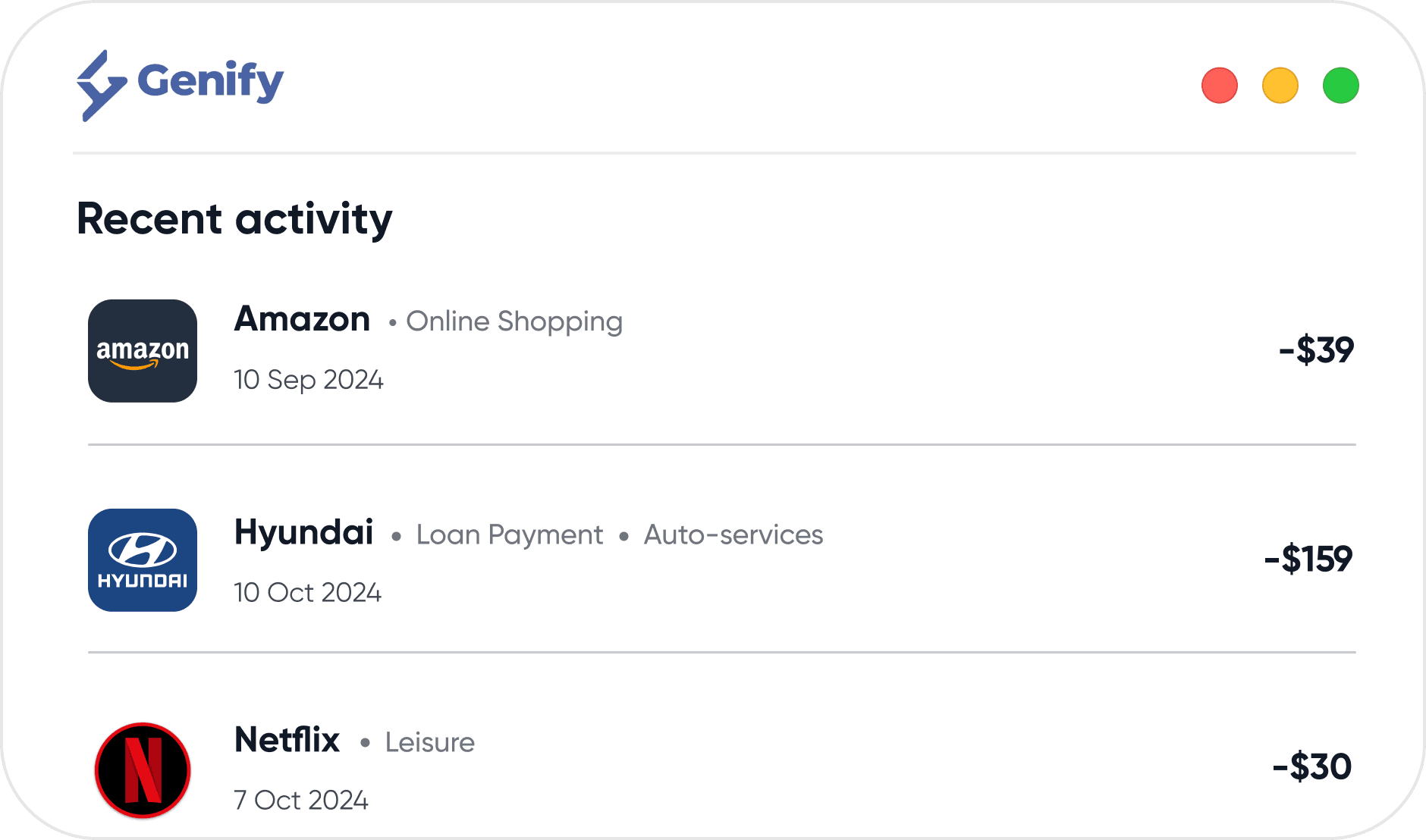

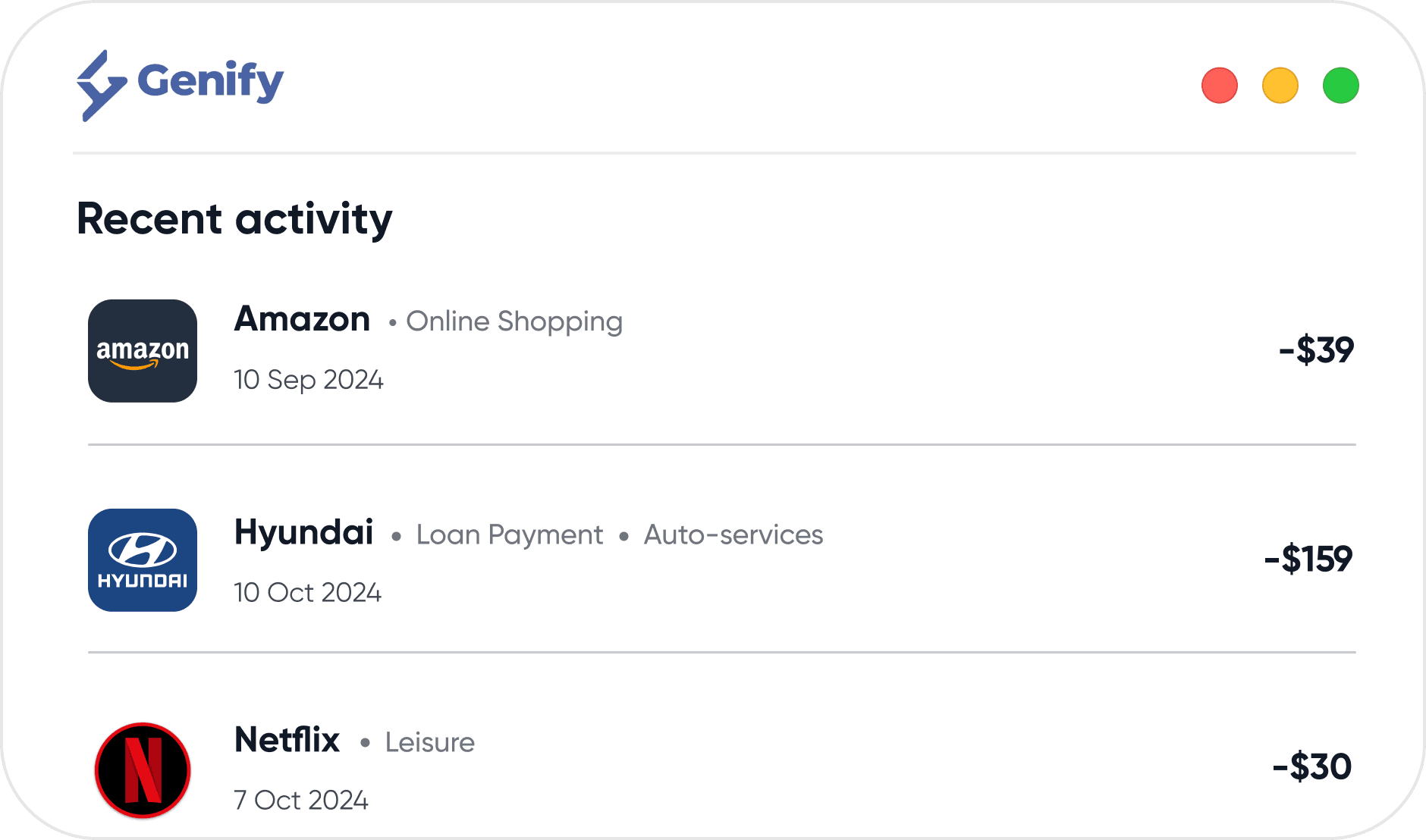

Merchant Logo

Make your users feel like home. Display logos of merchants in your banking app instead of dull, generic icons.

Merchant Logo

Make your users feel like home. Display logos of merchants in your banking app instead of dull, generic icons.

Merchant Logo

Make your users feel like home. Display logos of merchants in your banking app instead of dull, generic icons.

Clean Merchant Name

Do users enjoy deciphering transaction descriptions? Look no further.

Clean Merchant Name

Do users enjoy deciphering transaction descriptions? Look no further.

Clean Merchant Name

Do users enjoy deciphering transaction descriptions? Look no further.

Merchant Website

Link each expense with the website of the merchant associated with the transaction, for a sense of completeness and control.

Merchant Website

Link each expense with the website of the merchant associated with the transaction, for a sense of completeness and control.

Merchant Website

Link each expense with the website of the merchant associated with the transaction, for a sense of completeness and control.

Carbon Footprint

Inform your users about the carbon impact of every transaction and promote environmental awareness - One Transaction at a Time!

Carbon Footprint

Inform your users about the carbon impact of every transaction and promote environmental awareness - One Transaction at a Time!

Carbon Footprint

Inform your users about the carbon impact of every transaction and promote environmental awareness - One Transaction at a Time!

Use Cases

Grow your share of wallet thanks to Genify’s enriched transaction data

Grow your share of wallet thanks to Genify’s enriched transaction data

Delightful Transaction List

Offer the most visually appealing transaction feed.

Delightful Transaction List

Offer the most visually appealing transaction feed.

Delightful Transaction List

Offer the most visually appealing transaction feed.

Personal Finance Management

Help people understand where their money goes.

Personal Finance Management

Help people understand where their money goes.

Personal Finance Management

Help people understand where their money goes.

Personal Finance Management

Help people understand where their money goes.

Enhanced Customer Segmentation

Utilize transaction data to segment customers more effectively, allowing for targeted marketing and product offerings.

Enhanced Customer Segmentation

Utilize transaction data to segment customers more effectively, allowing for targeted marketing and product offerings.

Enhanced Customer Segmentation

Utilize transaction data to segment customers more effectively, allowing for targeted marketing and product offerings.

Features

Features

Features

Source-agnostic

Enrich transactions from any source, including open banking, card schemes, and bank extracts.

Source-agnostic

Enrich transactions from any source, including open banking, card schemes, and bank extracts.

Source-agnostic

Enrich transactions from any source, including open banking, card schemes, and bank extracts.

Multi-Lingual

Enrich transactions in English, العربية, русский, 中文 or any other language.

Multi-Lingual

Enrich transactions in English, العربية, русский, 中文 or any other language.

Multi-Lingual

Enrich transactions in English, العربية, русский, 中文 or any other language.

User Feedback Loop

Allow your users to make correction so Genify’s engine learns from all via API endpoint suggestions.

User Feedback Loop

Allow your users to make correction so Genify’s engine learns from all via API endpoint suggestions.

User Feedback Loop

Allow your users to make correction so Genify’s engine learns from all via API endpoint suggestions.

User Feedback Loop

Allow your users to make correction so Genify’s engine learns from all via API endpoint suggestions.

Batch API Calls

Enrich a batch of transactions in a single API call for API convenient integration.

Batch API Calls

Enrich a batch of transactions in a single API call.

Batch API Calls

Enrich a batch of transactions in a single API call.

Source-agnostic

Enrich transactions from any source, including open banking, card schemes, and bank extracts.

Source-agnostic

Enrich transactions from any source, including open banking, card schemes, and bank extracts.

Multi-Lingual

Enrich transactions in English, العربية, русский, 中文 or any other language.

Multi-Lingual

Enrich transactions in English, العربية, русский, 中文 or any other language.

Low Latency

Enrich transactions in real-time to provide insights as a transaction happens or as a user onboards to your app.

Low Latency

Enrich transactions in real-time to provide insights as a transaction happens or as a user onboards to your app.

Batch API Calls

Enrich a batch of transactions in a single API call.

Batch API Calls

Enrich a batch of transactions in a single API call.

Low Latency

Enrich transactions in real-time to provide insights as a transaction happens or as a user onboards to your app.

Low Latency

Enrich transactions in real-time to provide insights as a transaction happens or as a user onboards to your app.

Low Latency

Enrich transactions in real-time to provide insights as a transaction happens or as a user onboards to your app.

Use Cases

How Does the Transaction Data API Work?

How Does the Transaction Data API Work?

{

"Transaction UUID": "2c58685b-d2d5-48a8-9374-50e64cba92ac",

"Merchant ID": "00005af3107a89ac",

"Category ID": "2003",

"Category Name": "Furniture",

"Subcategory Name": "Furniture store",

"Clean Description": "Home Box",

"Country": "UNITED ARAB EMIRATES",

"Logo": "https://pfm.genify.ai/api/v1.0/txn-data/logo/home_box_round.png",

"Merchant Website": "https://www.homeboxstores.com",

"Display Description": "Home Box"

}{

"Transaction UUID": "2c58685b-d2d5-48a8-9374-50e64cba92ac",

"Merchant ID": "00005af3107a89ac",

"Category ID": "2003",

"Category Name": "Furniture",

"Subcategory Name": "Furniture store",

"Clean Description": "Home Box",

"Country": "UNITED ARAB EMIRATES",

"Logo": "https://pfm.genify.ai/api/v1.0/txn-data/logo/home_box_round.png",

"Merchant Website": "https://www.homeboxstores.com",

"Display Description": "Home Box"

}Transaction Data API

Transaction Data API

Transaction Data API

Our API enriches transaction data with five fields: category, merchant logo, clean merchant name, merchant website, and carbon footprint.

Our API enriches transaction data with five fields: category, merchant logo, clean merchant name, merchant website, and carbon footprint.

Our API enriches transaction data with five fields: category, merchant logo, clean merchant name, merchant website, and carbon footprint.

Enrichment Fields

Unlock value with 5 enrichment fields

Genify’s engine is designed to automatically categorize card (credit and debit) and account transactions into granular expense and income categories, leveraging machine learning to enhance the quality of bank transaction data. Our engine also provides a merchant’s clean name, logo, website, and calculates as bonus the carbon footprint of the transaction.

Category

Categorize transactions into more than 70 expense and income categories.

Category

Categorize transactions into more than 70 expense and income categories.

Merchant Logo

Make your users feel like home. Display logos of merchants in your banking app instead of dull, generic icons.

Merchant Logo

Make your users feel like home. Display logos of merchants in your banking app instead of dull, generic icons.

Clean Merchant Name

Do users enjoy deciphering transaction descriptions? Look no further.

Clean Merchant Name

Do users enjoy deciphering transaction descriptions? Look no further.

Merchant Website

Link each expense with the website of the merchant associated with the transaction, for a sense of completeness and control.

Merchant Website

Link each expense with the website of the merchant associated with the transaction, for a sense of completeness and control.

Carbon Footprint

Inform your users about the carbon impact of every transaction and promote environmental awareness - One Transaction at a Time!

Carbon Footprint

Inform your users about the carbon impact of every transaction and promote environmental awareness - One Transaction at a Time!

Experience Enhanced Data Insights – Try for Free

Enrich your data with fields like category, merchant logo, merchant name, website, and sustainability metrics. Try it now – it's free and easy to integrate.

Experience Enhanced Data Insights – Try for Free

Enrich your data with fields like category, merchant logo, merchant name, website, and sustainability metrics. Try it now – it's free and easy to integrate.

Experience Enhanced Data Insights – Try for Free

Enrich your data with fields like category, merchant logo, merchant name, website, and sustainability metrics. Try it now – it's free and easy to integrate.

Experience Enhanced Data Insights – Try for Free

Enrich your data with fields like category, merchant logo, merchant name, website, and sustainability metrics. Try it now – it's free and easy to integrate.

Experience Enhanced Data Insights – Try for Free

Enrich your data with fields like category, merchant logo, merchant name, website, and sustainability metrics. Try it now – it's free and easy to integrate.

Privacy Policy

·

Terms of Conditions

Genify AI Technologies LTD. All rights reserved.

Enrich Transactions

Transaction Data API

With our transaction data enrichment API, categorize card and account transactions in the most granular and accurate way and enrich transactions with all the information your users expect in their bank or fintech app.

The First Truly Global

Transaction Categorizer

01

Turnkey: plug and play API from day 1 No training needed

02

Country-agnostic: we enrich transactions from virtually all countries

03

A single API endpoint, returning 5 enrichment fields

Enrichment Fields

Unlock value with 5 enrichment fields

Genify’s engine is designed to automatically categorize card (credit and debit) and account transactions into granular expense and income categories, leveraging machine learning to enhance the quality of bank transaction data. Our engine also provides a merchant’s clean name, logo, website, and calculates as bonus the carbon footprint of the transaction.

Category

Categorize transactions into more than 70 expense and income categories.

Merchant Logo

Make your users feel like home. Display logos of merchants in your banking app instead of dull, generic icons.

Clean Merchant Name

Do users enjoy deciphering transaction descriptions? Look no further.

Merchant Website

Link each expense with the website of the merchant associated with the transaction, for a sense of completeness and control.

Carbon Footprint

Inform your users about the carbon impact of every transaction and promote environmental awareness - One Transaction at a Time!

Features

Source-agnostic

Enrich transactions from any source, including open banking, card schemes, and bank extracts.

Multi-Lingual

Enrich transactions in English, العربية, русский, 中文 or any other language.

User Feedback Loop

Allow your users to make correction so Genify’s engine learns from all via API endpoint suggestions.

Low Latency

Enrich transactions in real-time to provide insights as a transaction happens or as a user onboards to your app.

Batch API Calls

Enrich a batch of transactions in a single API call.

Grow your share of wallet thanks to Genify’s enriched transaction data

Delightful Transaction List

Offer the most visually appealing transaction feed.

Personal Finance Management

Help people understand where their money goes.

Business Finance Management

Unlock full cash flow transparency, enabling businesses to make informed and strategic financial decisions.

Insights

Why Genify?

Your partner to unlock value in transaction data

Ease of Integration

Via a vast, well-documented set of API endpoints

On Premises or Cloud

Our API runs on your premises or in the cloud, thanks to a hybrid build since Day 1

Home

Card

Profile

Transaction

Total balance

$42,295.00 USD

Toni Kross

Good Morning

$300 Budgeted

Shopping Online

$230

$400 Budgeted

Groceries

$201

$400 Budgeted

Food & Drink

$201

$120 Budgeted

Beauty

$40

$120 Budgeted

Health

$10

ISO 27001

Our servers are ISO 27001 certified, and our data usage is compliant with GDPR

Continuous Upgrades

Your subscription gives access to new features, sourced directly from our existing users

How Does the Transaction Data API Work?

{

"Transaction UUID": "2c58685b-d2d5-48a8-9374-50e64cba92ac",

"Merchant ID": "00005af3107a89ac",

"Category ID": "2003",

"Category Name": "Furniture",

"Subcategory Name": "Furniture store",

"Clean Description": "Home Box",

"Country": "UNITED ARAB EMIRATES",

"Logo": "https://pfm.genify.ai/api/v1.0/txn-data/logo/home_box_round.png",

"Merchant Website": "https://www.homeboxstores.com",

"Display Description": "Home Box"

}Transaction Data API

Our API enriches transaction data with five fields: category, merchant logo, clean merchant name, merchant website, and carbon footprint.

View API Documentation

Experience Enhanced Data Insights – Try for Free

Enrich your data with fields like category, merchant logo, merchant name, website, and sustainability metrics. Try it now – it's free and easy to integrate.

Privacy Policy

·

Terms of Conditions

Genify AI Technologies LTD. All rights reserved.

Privacy Policy

·

Terms of Conditions

Genify AI Technologies LTD. All rights reserved.

Privacy Policy

·

Terms of Conditions

Genify AI Technologies LTD. All rights reserved.

Privacy Policy

·

Terms of Conditions

Genify AI Technologies LTD. All rights reserved.