Personal Financial Management

AI Personal Financial Manager

AI Personal Financial Manager

AI Personal Financial Manager

Genify’s chat-based personalized finance assistant. Built using Genify’s industry-leading APIs for transaction enrichment and transaction analytics, on top of an open-source LLM.

Genify’s chat-based personalized finance assistant. Built using Genify’s industry-leading APIs for transaction enrichment and transaction analytics, on top of an open-source LLM.

Genify’s chat-based personalized finance assistant. Built using Genify’s industry-leading APIs for transaction enrichment and transaction analytics, on top of an open-source LLM.

Financial Chat Interface

Financial Chat Interface

Financial Chat Interface

Full PFM Access via Chat Interface

Full PFM Access via Chat Interface

Full PFM Access via Chat Interface

Genify brings a comprehensive PFM experience directly to your chat interface. Powered by an optimized open-source LLM and years of PFM software expertise, this unified solution combines all Genify APIs in a single product, offering seamless Personal Financial Management without needing a complex front end.

Genify brings a comprehensive PFM experience directly to your chat interface. Powered by an optimized open-source LLM and years of PFM software expertise, this unified solution combines all Genify APIs in a single product, offering seamless Personal Financial Management without needing a complex front end.

Genify brings a comprehensive PFM experience directly to your chat interface. Powered by an optimized open-source LLM and years of PFM software expertise, this unified solution combines all Genify APIs in a single product, offering seamless Personal Financial Management without needing a complex front end.

Spending Analysis

Provide users with detailed insights into their spending habits, categorized by type, merchant, and location to promote informed financial decisions.

Spending Analysis

Provide users with detailed insights into their spending habits, categorized by type, merchant, and location to promote informed financial decisions.

Spending Analysis

Provide users with detailed insights into their spending habits, categorized by type, merchant, and location to promote informed financial decisions.

Spending Analysis

Provide users with detailed insights into their spending habits, categorized by type, merchant, and location to promote informed financial decisions.

Saving Tips

Empower users to save effectively by providing personalized insights, automated saving tools, and real-time alerts based on spending habits. They simplify financial management, helping users set goals, track progress, and optimize their savings effortlessly.

Saving Tips

Empower users to save effectively by providing personalized insights, automated saving tools, and real-time alerts based on spending habits. They simplify financial management, helping users set goals, track progress, and optimize their savings effortlessly.

Saving Tips

Empower users to save effectively by providing personalized insights, automated saving tools, and real-time alerts based on spending habits. They simplify financial management, helping users set goals, track progress, and optimize their savings effortlessly.

Saving Tips

Empower users to save effectively by providing personalized insights, automated saving tools, and real-time alerts based on spending habits. They simplify financial management, helping users set goals, track progress, and optimize their savings effortlessly.

Smart X Selling Suggestions

Empower users to make informed financial decisions by recommending relevant product upgrades and cross-sell opportunities, increasing customer engagement and providing valuable support.

Smart X Selling Suggestions

Empower users to make informed financial decisions by recommending relevant product upgrades and cross-sell opportunities, increasing customer engagement and providing valuable support.

Smart X Selling Suggestions

Empower users to make informed financial decisions by recommending relevant product upgrades and cross-sell opportunities, increasing customer engagement and providing valuable support.

Smart X Selling Suggestions

Empower users to make informed financial decisions by recommending relevant product upgrades and cross-sell opportunities, increasing customer engagement and providing valuable support.

Features

Features

Financial Planning

Assist users in setting personalized budgets and savings goals, offering tailored recommendations to achieve their financial objectives.

Financial Planning

Assist users in setting personalized budgets and savings goals, offering tailored recommendations to achieve their financial objectives.

Financial Planning

Assist users in setting personalized budgets and savings goals, offering tailored recommendations to achieve their financial objectives.

Financial Planning

Assist users in setting personalized budgets and savings goals, offering tailored recommendations to achieve their financial objectives.

Financial Planning

Assist users in setting personalized budgets and savings goals, offering tailored recommendations to achieve their financial objectives.

Cloud Deployment Solutions

Deployable across any corporate cloud instance, ensuring seamless scalability and enhanced operational efficiency.

Cloud Deployment Solutions

Deployable across any corporate cloud instance, ensuring seamless scalability and enhanced operational efficiency.

Cloud Deployment Solutions

Deployable across any corporate cloud instance, ensuring seamless scalability and enhanced operational efficiency.

Cloud Deployment Solutions

Deployable across any corporate cloud instance, ensuring seamless scalability and enhanced operational efficiency.

Cloud Deployment Solutions

Deployable across any corporate cloud instance, ensuring seamless scalability and enhanced operational efficiency.

Multi-Lingual

Enrich transactions in English, العربية, русский, 中文 or any other language.

Multi-Lingual

Enrich transactions in English, العربية, русский, 中文 or any other language.

Multi-Lingual

Enrich transactions in English, العربية, русский, 中文 or any other language.

Multi-Lingual

Enrich transactions in English, العربية, русский, 中文 or any other language.

Multi-Lingual

Enrich transactions in English, العربية, русский, 中文 or any other language.

Bank’s Product Information

Present relevant banking products, such as accounts, cards, loans, and subscriptions, assessing eligibility in real-time through user interactions.

Bank’s Product Information

Present relevant banking products, such as accounts, cards, loans, and subscriptions, assessing eligibility in real-time through user interactions.

Bank’s Product Information

Present relevant banking products, such as accounts, cards, loans, and subscriptions, assessing eligibility in real-time through user interactions.

Bank’s Product Information

Present relevant banking products, such as accounts, cards, loans, and subscriptions, assessing eligibility in real-time through user interactions.

On-Prem/Private Cloud

Provide flexible deployment options, including on-premises and private cloud solutions, to ensure data security and compliance.

On-Prem/Private Cloud

Provide flexible deployment options, including on-premises and private cloud solutions, to ensure data security and compliance.

On-Prem/Private Cloud

Provide flexible deployment options, including on-premises and private cloud solutions, to ensure data security and compliance.

On-Prem/Private Cloud

Provide flexible deployment options, including on-premises and private cloud solutions, to ensure data security and compliance.

Grow your share of wallet thanks to Genify’s enriched transaction data

Grow your share of wallet thanks to Genify’s enriched transaction data

Bank Product Information Retrieval

Allow retail banking users to inquire about specific banking products via chat. Users can instantly access detailed product information from product sheets and webpages, tailored to their requests.

Bank Product Information Retrieval

Allow retail banking users to inquire about specific banking products via chat. Users can instantly access detailed product information from product sheets and webpages, tailored to their requests.

Bank Product Information Retrieval

Allow retail banking users to inquire about specific banking products via chat. Users can instantly access detailed product information from product sheets and webpages, tailored to their requests.

Bank Product Information Retrieval

Allow retail banking users to inquire about specific banking products via chat. Users can instantly access detailed product information from product sheets and webpages, tailored to their requests.

Personalized Savings Plans

Enable users to ask for tailored savings plans through chat, such as "How can I save for a trip to Thailand?" The assistant provides a clear, customized savings plan based on user inquiries and spending habits.

Personalized Savings Plans

Enable users to ask for tailored savings plans through chat, such as "How can I save for a trip to Thailand?" The assistant provides a clear, customized savings plan based on user inquiries and spending habits.

Personalized Savings Plans

Enable users to ask for tailored savings plans through chat, such as "How can I save for a trip to Thailand?" The assistant provides a clear, customized savings plan based on user inquiries and spending habits.

Personalized Savings Plans

Enable users to ask for tailored savings plans through chat, such as "How can I save for a trip to Thailand?" The assistant provides a clear, customized savings plan based on user inquiries and spending habits.

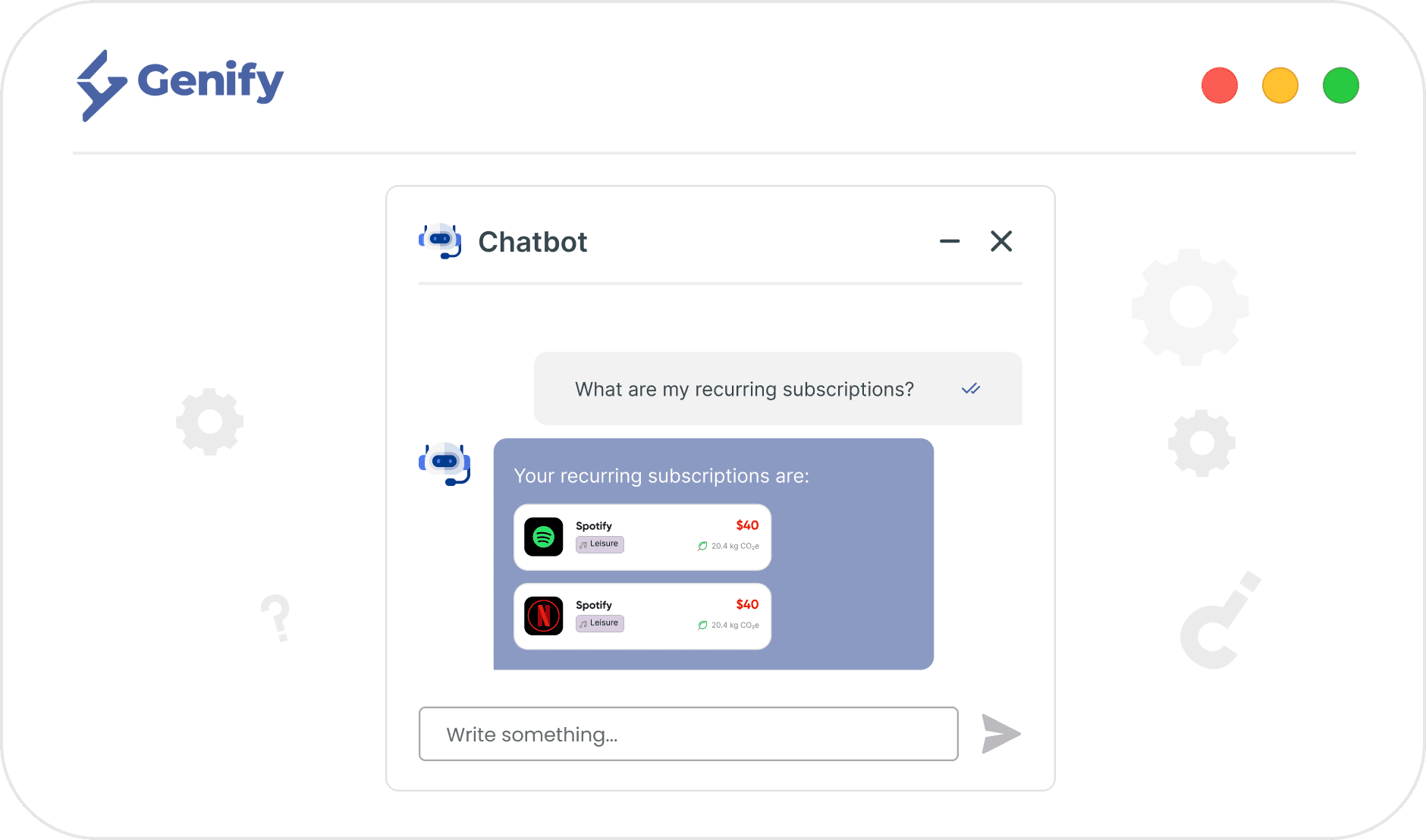

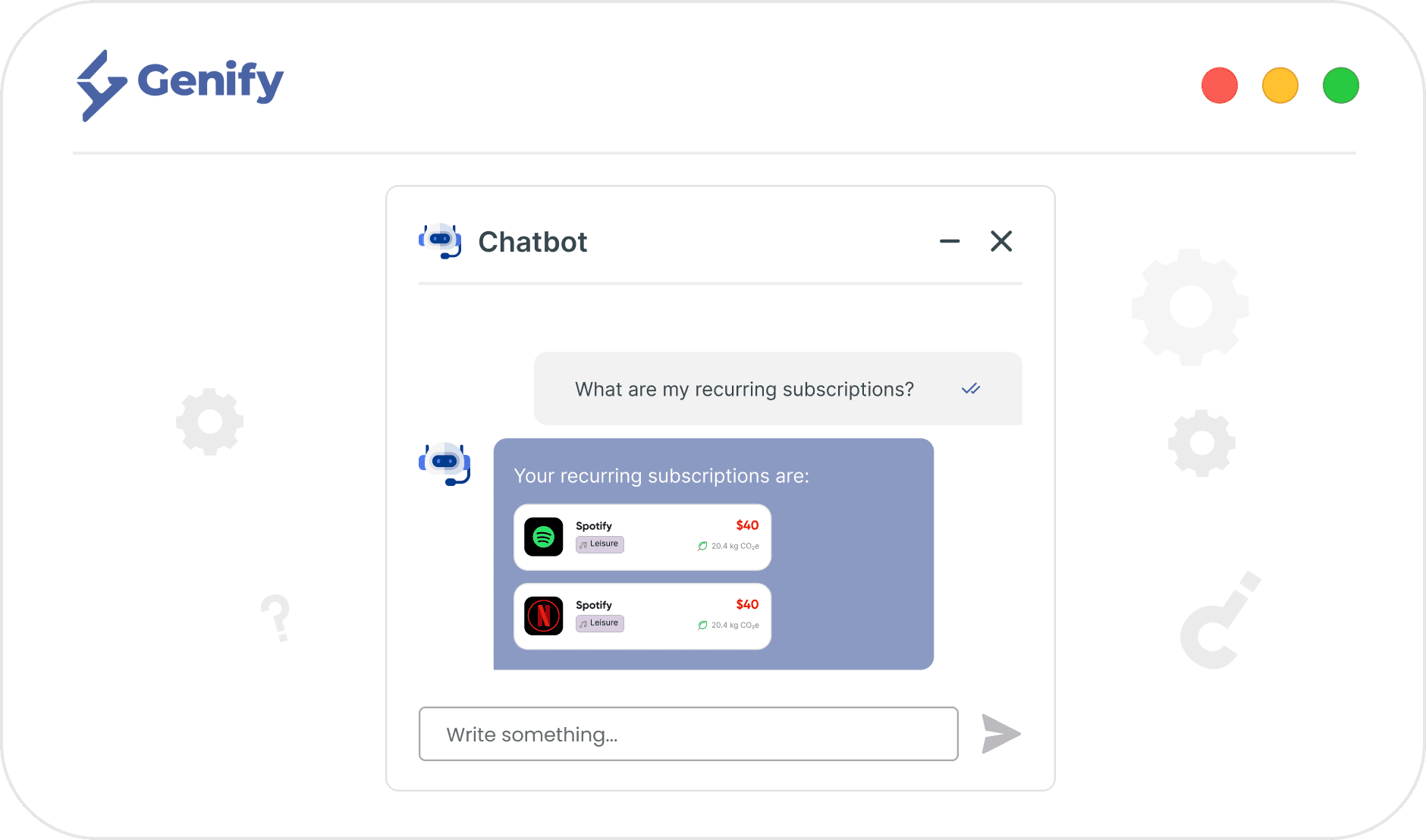

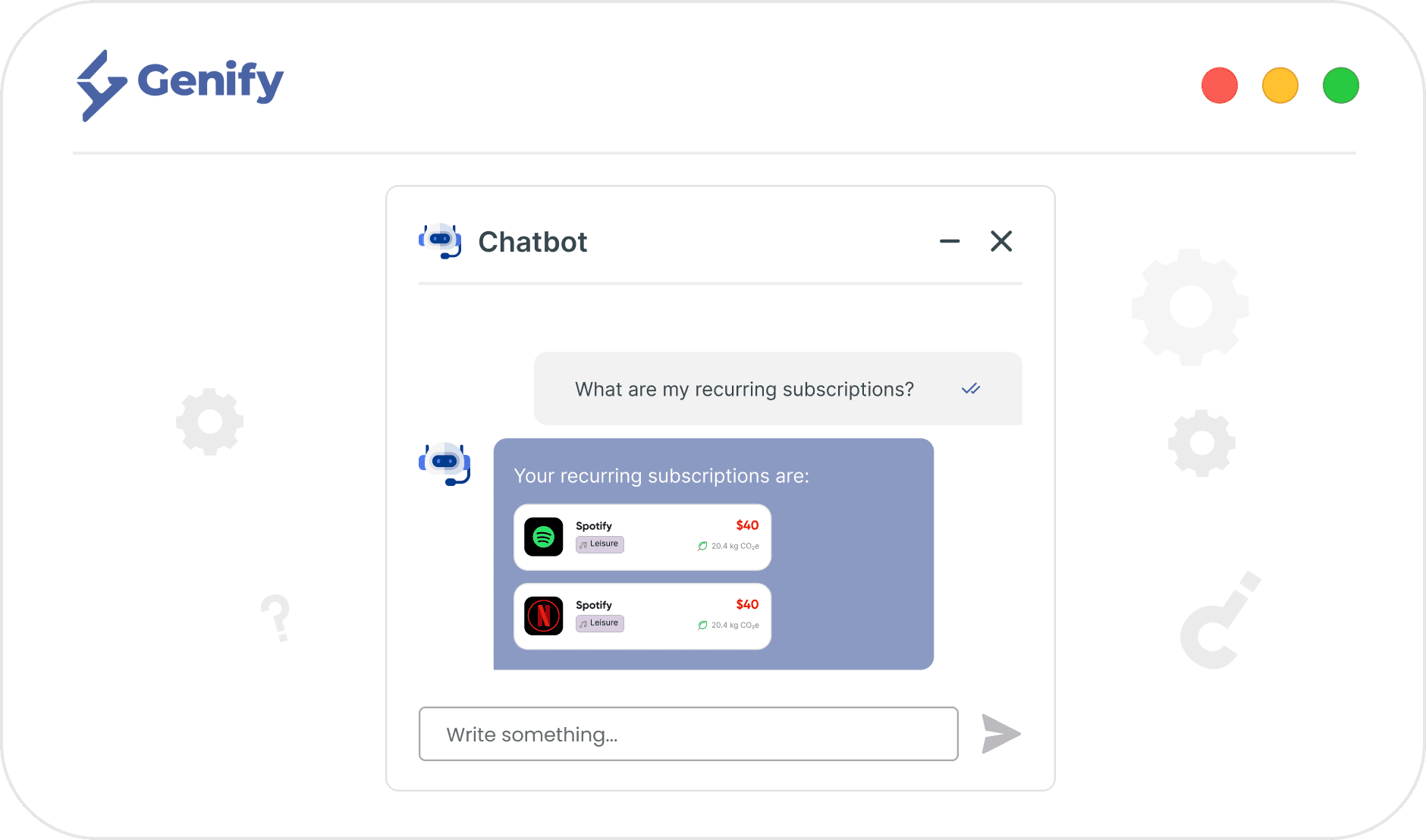

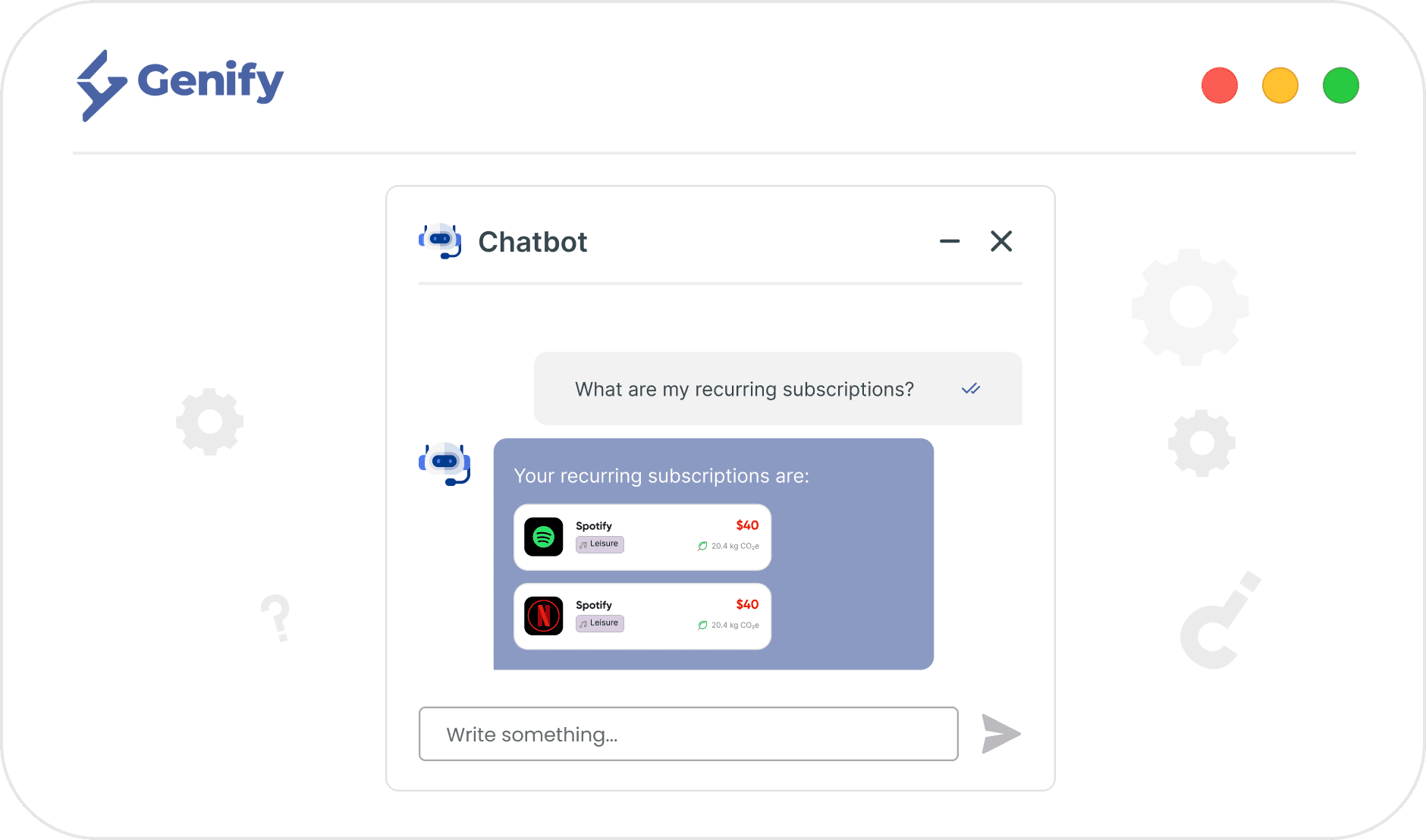

Recurring Transactions Insights

Users can inquire about their recurring transactions and subscriptions via chat. The assistant responds with a list of merchants, recurring amounts (or averages), and monthly payment dates, helping users track and manage regular expenses effectively.

Recurring Transactions Insights

Users can inquire about their recurring transactions and subscriptions via chat. The assistant responds with a list of merchants, recurring amounts (or averages), and monthly payment dates, helping users track and manage regular expenses effectively.

Recurring Transactions Insights

Users can inquire about their recurring transactions and subscriptions via chat. The assistant responds with a list of merchants, recurring amounts (or averages), and monthly payment dates, helping users track and manage regular expenses effectively.

Recurring Transactions Insights

Users can inquire about their recurring transactions and subscriptions via chat. The assistant responds with a list of merchants, recurring amounts (or averages), and monthly payment dates, helping users track and manage regular expenses effectively.

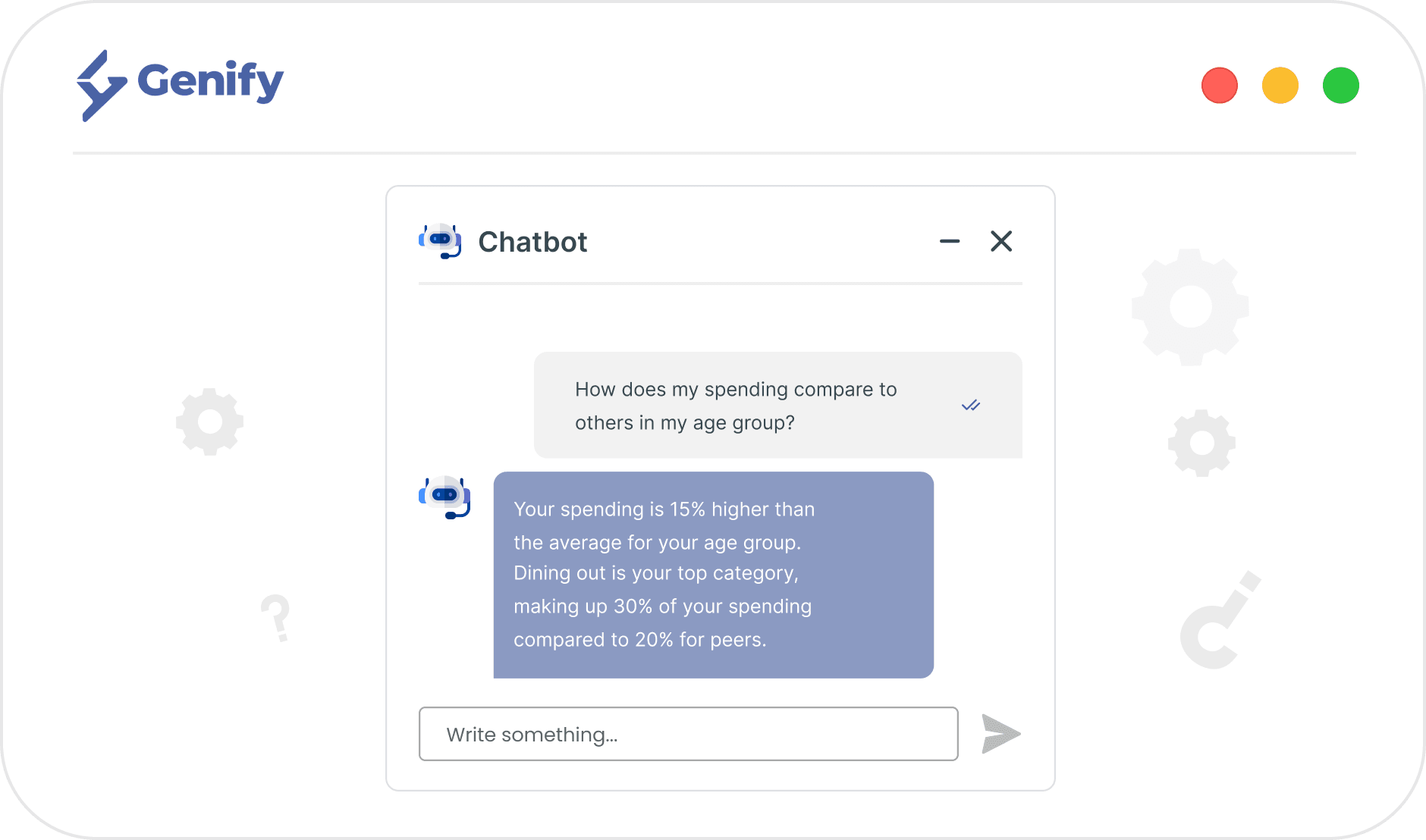

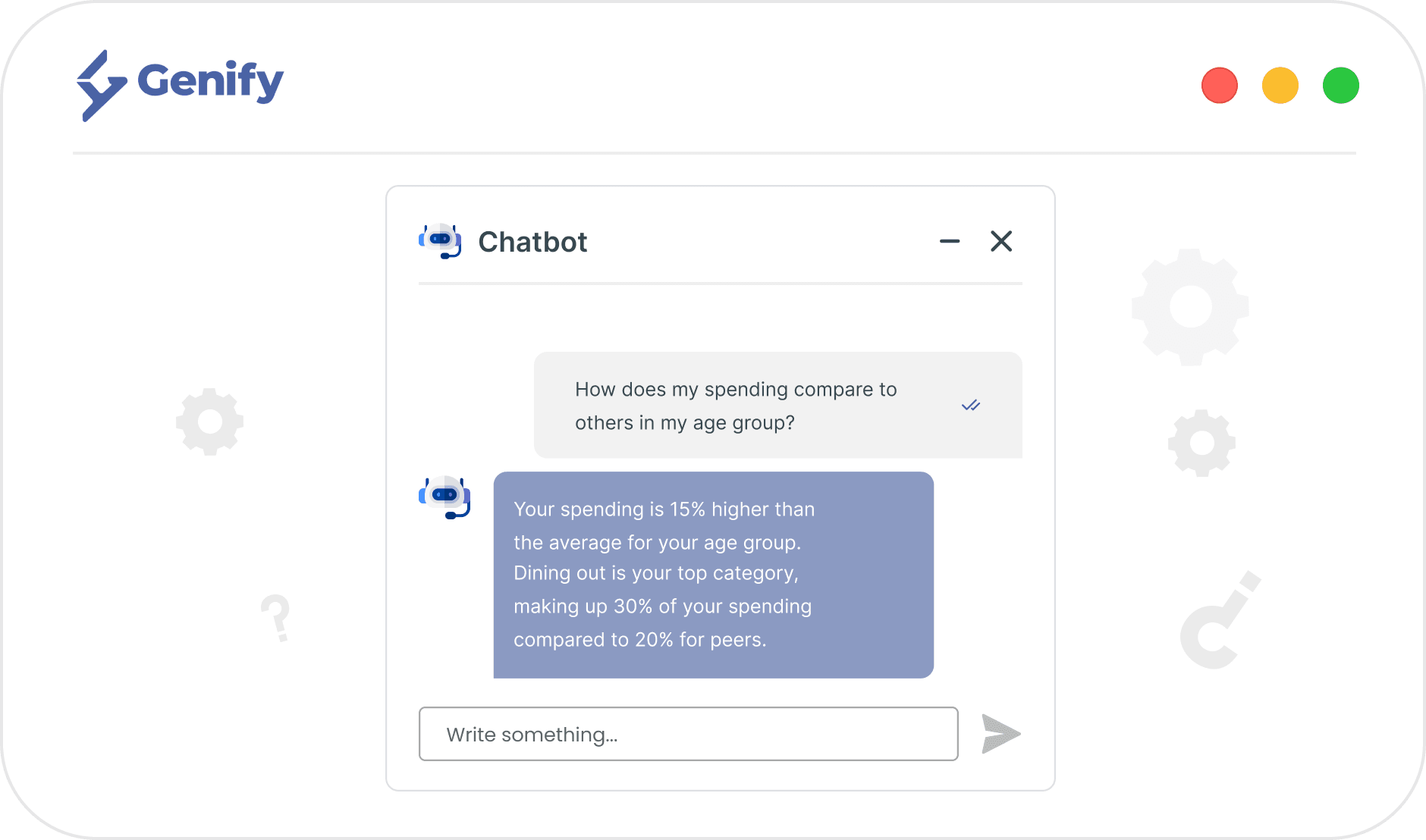

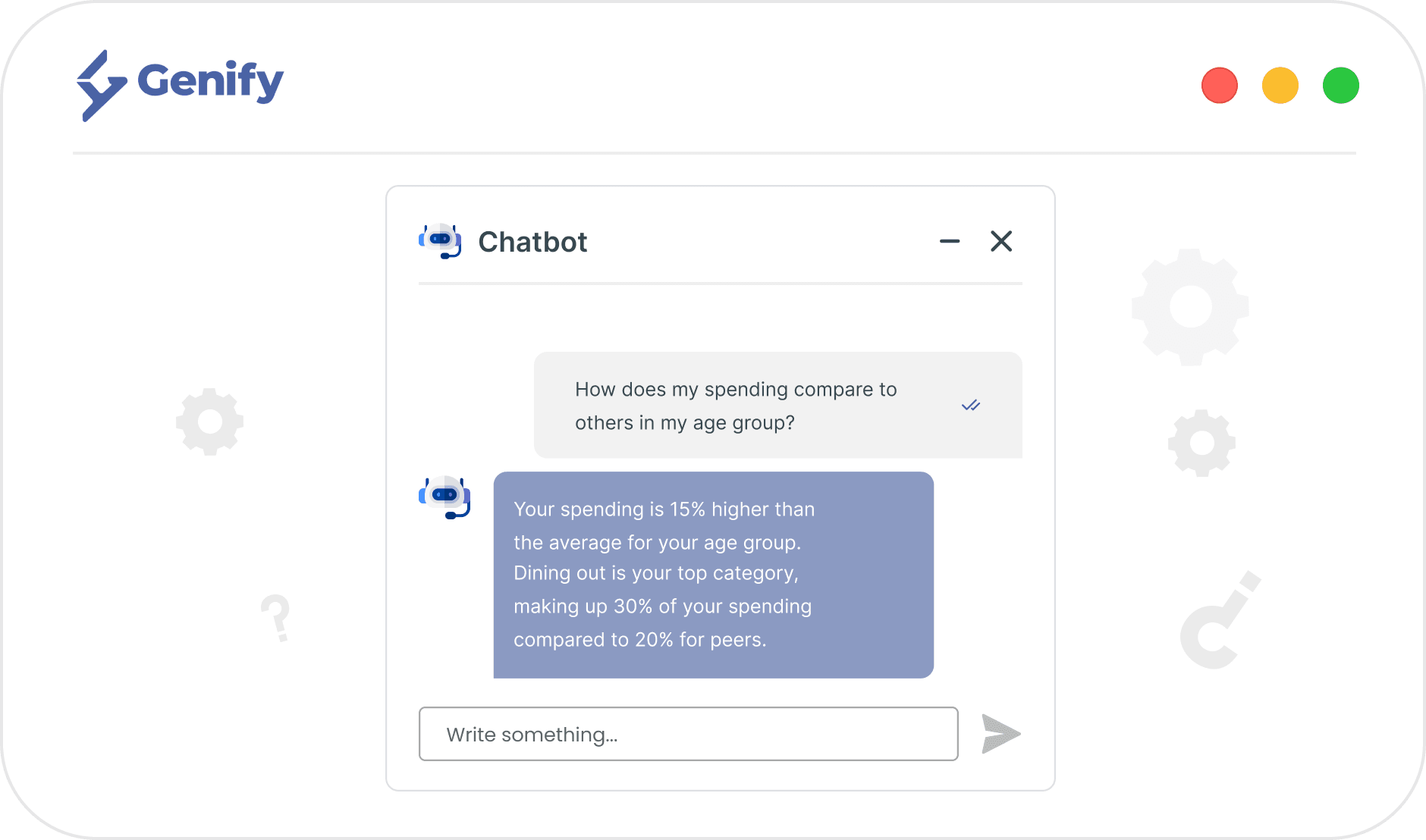

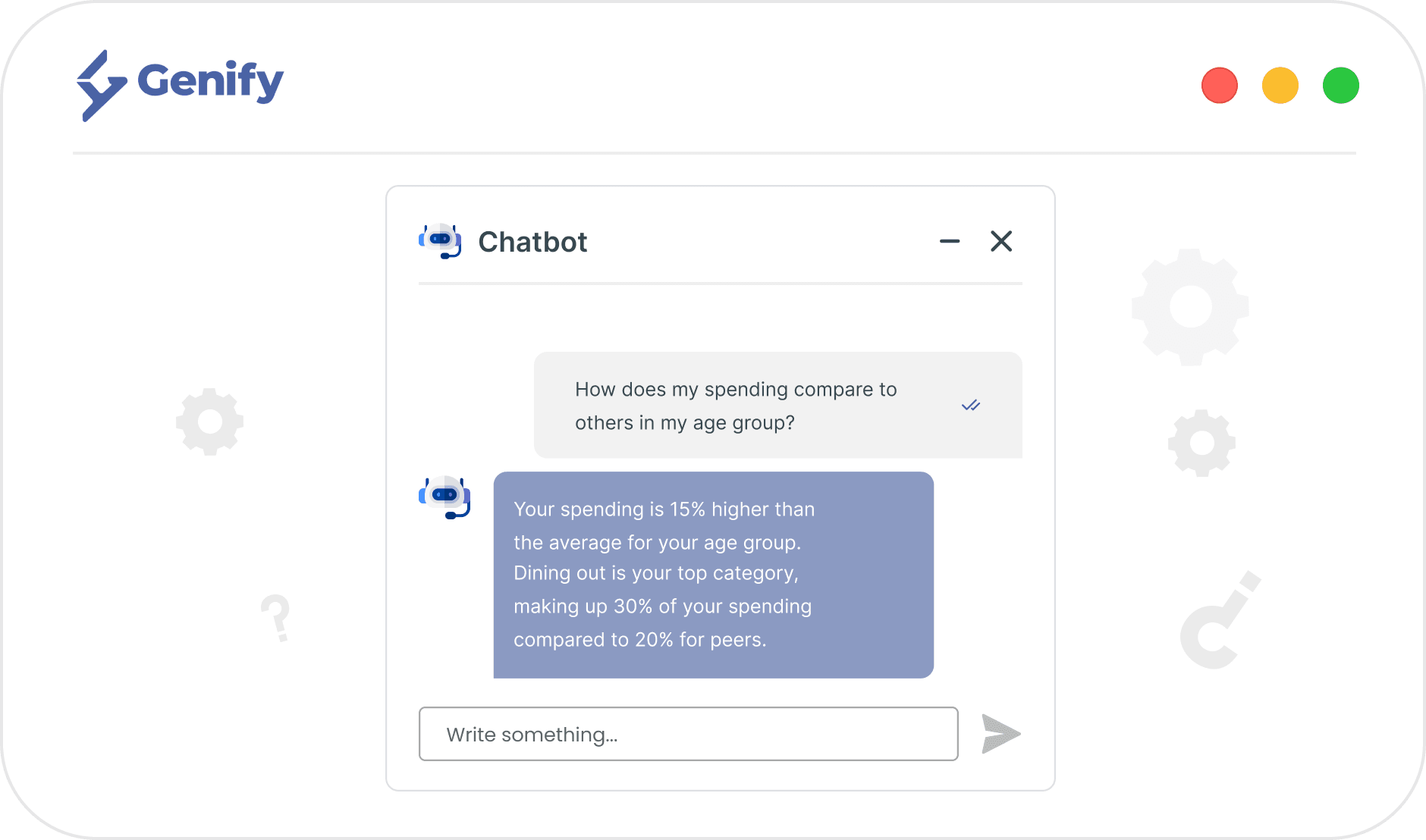

Peer Spending Comparison

Users can ask how their spending profile compares to their income or age group peers. The assistant provides insights based on bank-defined segments, helping users understand and optimize their spending.

Peer Spending Comparison

Users can ask how their spending profile compares to their income or age group peers. The assistant provides insights based on bank-defined segments, helping users understand and optimize their spending.

Peer Spending Comparison

Users can ask how their spending profile compares to their income or age group peers. The assistant provides insights based on bank-defined segments, helping users understand and optimize their spending.

Peer Spending Comparison

Users can ask how their spending profile compares to their income or age group peers. The assistant provides insights based on bank-defined segments, helping users understand and optimize their spending.

Mortgage Advisor Support

Mortgage advisors can access detailed spending data on applicants to guide conversations with potential borrowers. If an applicant is initially rejected, the advisor can offer actionable feedback on spending adjustments needed to qualify for a mortgage.

Mortgage Advisor Support

Mortgage advisors can access detailed spending data on applicants to guide conversations with potential borrowers. If an applicant is initially rejected, the advisor can offer actionable feedback on spending adjustments needed to qualify for a mortgage.

Mortgage Advisor Support

Mortgage advisors can access detailed spending data on applicants to guide conversations with potential borrowers. If an applicant is initially rejected, the advisor can offer actionable feedback on spending adjustments needed to qualify for a mortgage.

Mortgage Advisor Support

Mortgage advisors can access detailed spending data on applicants to guide conversations with potential borrowers. If an applicant is initially rejected, the advisor can offer actionable feedback on spending adjustments needed to qualify for a mortgage.

Competitive Product Comparison for Bank Staff

Bank staff can use the chat assistant to compare banking products against competitors, like checking monthly interest rates on specific credit cards. The system provides updated text or table format information, helping product and relationship managers stay informed.

Competitive Product Comparison for Bank Staff

Bank staff can use the chat assistant to compare banking products against competitors, like checking monthly interest rates on specific credit cards. The system provides updated text or table format information, helping product and relationship managers stay informed.

Competitive Product Comparison for Bank Staff

Bank staff can use the chat assistant to compare banking products against competitors, like checking monthly interest rates on specific credit cards. The system provides updated text or table format information, helping product and relationship managers stay informed.

Competitive Product Comparison for Bank Staff

Bank staff can use the chat assistant to compare banking products against competitors, like checking monthly interest rates on specific credit cards. The system provides updated text or table format information, helping product and relationship managers stay informed.

Customer Service Assistance for Product Information

Customer service agents, regardless of training, can input customer questions about specific products into the chat interface and retrieve accurate, up-to-date information almost instantly, improving response quality and speed.

Customer Service Assistance for Product Information

Customer service agents, regardless of training, can input customer questions about specific products into the chat interface and retrieve accurate, up-to-date information almost instantly, improving response quality and speed.

Customer Service Assistance for Product Information

Customer service agents, regardless of training, can input customer questions about specific products into the chat interface and retrieve accurate, up-to-date information almost instantly, improving response quality and speed.

Customer Service Assistance for Product Information

Customer service agents, regardless of training, can input customer questions about specific products into the chat interface and retrieve accurate, up-to-date information almost instantly, improving response quality and speed.

Insights

Why Genify?

Your partner to unlock value in transaction data

Ease of Integration

Via a vast, well-documented set of API endpoints

On Premises or Cloud

Our API runs on your premises or in the cloud, thanks to a hybrid build since Day 1

Home

Card

Profile

Transaction

Total balance

$42,295.00 USD

Toni Kross

Good Morning

$300 Budgeted

Shopping Online

$230

$400 Budgeted

Groceries

$201

$400 Budgeted

Food & Drink

$201

$120 Budgeted

Beauty

$40

$120 Budgeted

Health

$10

ISO 27001

Our servers are ISO 27001 certified, and our data usage is compliant with GDPR

Continuous Upgrades

Your subscription gives access to new features, sourced directly from our existing users

Insights

Why Genify?

Your partner to unlock value in transaction data

Ease of Integration

Via a vast, well-documented set of API endpoints

On Premises or Cloud

Our API runs on your premises or in the cloud, thanks to a hybrid build since Day 1

ISO 27001

Our servers are ISO 27001 certified, and our data usage is compliant with GDPR

Continuous Upgrades

Your subscription gives access to new features, sourced directly from our existing users

Insights

Why Genify?

Your partner to unlock value in transaction data

Ease of Integration

Via a vast, well-documented set of API endpoints

On Premises or Cloud

Our API runs on your premises or in the cloud, thanks to a hybrid build since

Day 1

ISO 27001

Our servers are ISO 27001 certified, and our data usage is compliant with GDPR

Continuous Upgrades

Your subscription gives access to new features, sourced directly from our existing users

Home

Card

Profile

Transaction

Total balance

$42,295.00 USD

Toni Kross

Good Morning

$300 Budgeted

Shopping Online

$230

$400 Budgeted

Groceries

$201

$400 Budgeted

Food & Drink

$201

$120 Budgeted

Beauty

$40

$120 Budgeted

Health

$10

Insights

Why Genify?

Your partner to unlock value in transaction data

Ease of Integration

Via a vast, well-documented set of API endpoints

On Premises or Cloud

Our API runs on your premises or in the cloud, thanks to a hybrid build since Day 1

ISO 27001

Our servers are ISO 27001 certified, and our data usage is compliant with GDPR

Continuous Upgrades

Your subscription gives access to new features, sourced directly from our existing users

Experience Enhanced Data Insights – Try for Free

Enrich your data with fields like category, merchant logo, merchant name, website, and sustainability metrics. Try it now – it's free and easy to integrate.

Experience Enhanced Data Insights – Try for Free

Enrich your data with fields like category, merchant logo, merchant name, website, and sustainability metrics. Try it now – it's free and easy to integrate.

Experience Enhanced Data Insights – Try for Free

Enrich your data with fields like category, merchant logo, merchant name, website, and sustainability metrics. Try it now – it's free and easy to integrate.

Experience Enhanced Data Insights – Try for Free

Enrich your data with fields like category, merchant logo, merchant name, website, and sustainability metrics. Try it now – it's free and easy to integrate.

Privacy Policy

·

Terms of Conditions

Genify AI Technologies LTD. All rights reserved.

Privacy Policy

·

Terms of Conditions

Genify AI Technologies LTD. All rights reserved.

Privacy Policy

·

Terms of Conditions

Genify AI Technologies LTD. All rights reserved.

Privacy Policy

·

Terms of Conditions

Genify AI Technologies LTD. All rights reserved.