Transcations

Transaction Categorization API

Enrich transaction data with all the information your users expect in their banking or fintech app.

Credit Scoring API

Score your loan applicants effortlessly with hosted and customizable credit scoring models. Offer financing to unbanked individuals assessed via alternative data sources and meeting your risk requirements.

Ease of Integration

Via a vast, well-documented set of API endpoints

ISO 27001

Our servers are ISO 27001 certified, and our data usage is compliant with GDPR

On Premises or Cloud

Our API runs on your premises or in the cloud, thanks to a hybrid build since Day 1

Continuous upgrades

Your subscription gives access to new features, sourced directly from our existing users

Use cases

Power your fintech products with Genify

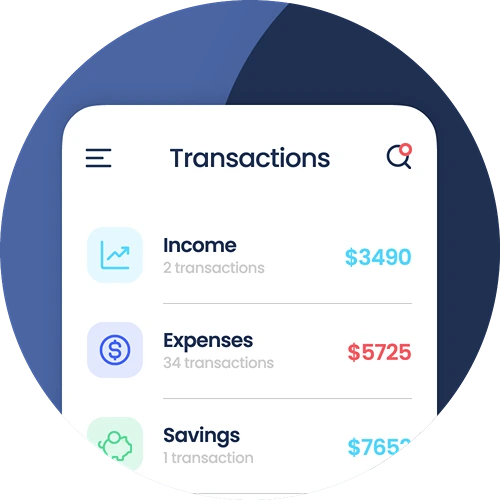

Delightful Transaction List

Offer the most visually appealing transaction feed.

Personal Finance Management

Help people understand where their money goes.

Business Finance Management

Unlock cash flow transparency for business.

Credit Decisioning Automation

Encode your business rules and decision trees for automated lending decisioning.

Instant Loan Approval

Leverage the power of alternative data for underwriting.

Start Testing Today

Get in touch for a demo with our technical sales team.